Between Jun first week and Aug 14th every other stock exchange has gone through the same pattern. A wave pattern that I had explained in my previous post http://analyzestockmarket.blogspot.com/2012/08/nifty-jun-4th-to-aug-14th-12-eod.html

Elliot wave pattern especially is amazingly followed through out the globe and when I study any exchange all I get to see is this pattern i.e. an initial 5 wave impulsive pattern, followed by a 3 wave A, B and C corrective pattern and again followed by a 5 wave impulsive pattern

Let me show you some exchanges which will definitely throw up some light on how financial markets are tied to each other and how investors globally manage the entire show

FTSE (Financial Times and Stock Exchange) FTSE 100 on London Stock Exchange

The above wave pattern that I first explained has completely taken shape from Jun 1st till date and it all shows that this run on NIFTY is mostly driven basis global factors than on domestic factors

NASDAQ Composite

Going by the same Elliot wave pattern, we find the same thing occuring on charts

France CAC 40

Same pattern on Elliot wave observed here as well

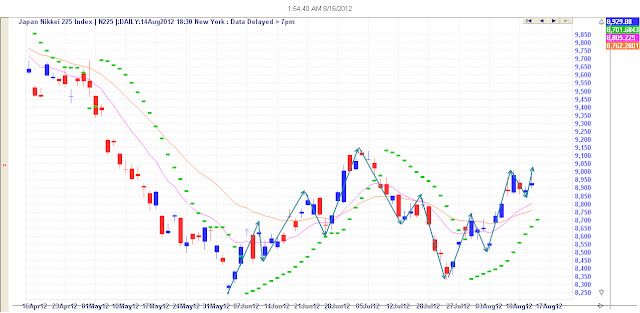

Japan Nikkei

Elliot wave pattern observed in Asian markets

No comments:

Post a Comment